Today, Meme Coins vs Utility Tokens is a central debate for crypto investors and enthusiasts. Hype in the community and speculation drive the popularity of Meme coins. Utility tokens, on the other hand, are able to power real-world blockchain applications such as payments and governance.

It is critical to understand ‘What is the difference between a meme coin and a utility token?’ This is because regulators have already started to tighten their oversight, and markets are growing more volatile in nature. Let us explore these digital assets in detail and help investors make a smart choice.

A Deep Dive into Meme Coins and Utility Tokens

In 2025, both Meme Coins and Utility Tokens will influence the crypto space. Meme Coins are fundamentally crypto tokens that are hype-driven, and they thrive on viral momentum and community trends. Utility tokens are assets having real-world blockchain utility. These tokens facilitate payments and provide access to digital services.

Meme Coins are viral and speculative in nature. But Utility Tokens function within blockchain ecosystems. It is essential to understand the concept of utility tokens and meme coins to make smart investment decisions.

Enroll now in the Bitcoin Fundamentals Free Course to gain deep insights on how the Bitcoin blockchain works.

Perspective of Regulators on Meme Coins and Utility Tokens

In recent times, the Meme Coins vs Utility Tokens debate has reached the regulators in the United States. As a result, the regulatory landscape has undergone major change, and regulators have been sharpening their stance on these virtual assets.

The United States Securities and Exchange Commission (SEC), in February 2025, introduced a staff statement on meme coins. In this publication, it has been clarified that diverse meme coins cannot be considered as securities. Therefore, investors must not assume that they can seek protection under the federal securities laws.

The scenario surrounding Utility tokens is very different. This is because the specific digital asset remains under close scrutiny from regulators. Since they have been designed for granting access to blockchain services like payments and governance rights, the SEC, as well as the Commodity Futures Trading Commission (CFTC), have stated that these tokens may fall within securities or commodities oversight in case they resemble investment contracts. When talking about – What is the difference between a meme coin and a utility token? This is a major distinction that you need to take into account.

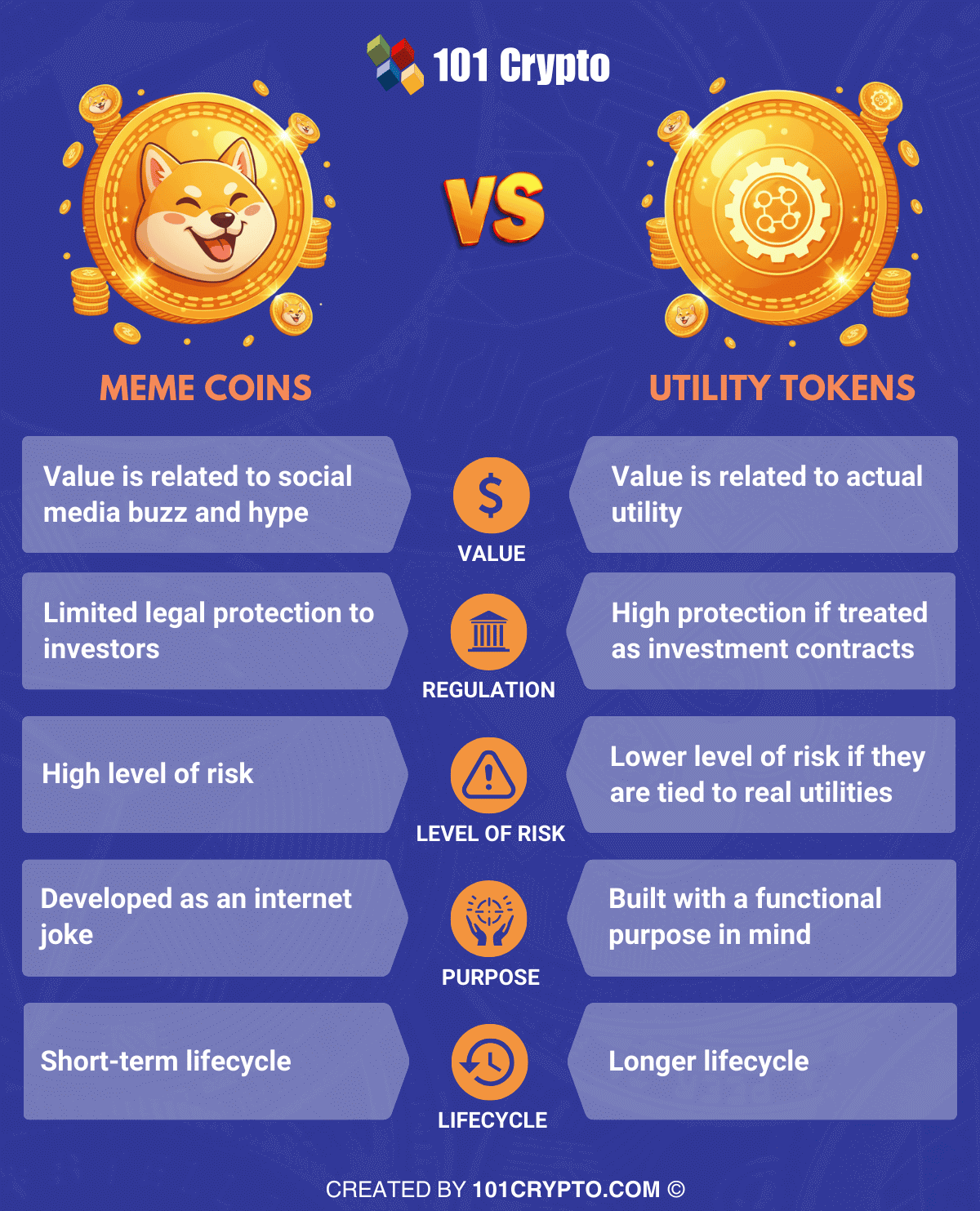

Difference between Meme Coins and Utility Tokens

There exist several differences between a utility token and a meme coin. It is key to know the differences between these popular assets. A clarity into Meme Coins vs Utility Tokens can definitely help you make smart investment choices.

When discussing the topic relating to Utility Tokens vs Meme Coins, the main differences come down to the following areas:

-

Value

The value of meme coins depends on elements such as social media buzz and hype. Similarly, endorsements by a celebrity may impact meme coins’ value. Their intrinsic utility plays little role in influencing their value.

When it comes to utility tokens, their value is driven by their functional role within a blockchain ecosystem. You can gain access to digital services and pay transaction fees while using these tokens. Users also have the option to unlock diverse platform features to meet their needs.

-

Regulatory distinction

From the regulatory perspective, there is a major difference between meme coins and utility tokens. Investors need to look at Meme Coins vs Utility Tokens from the regulatory angle, as it can significantly impact their investment choice.

Meme coins mostly fall outside security protection. The 2025 guidelines issued by the SEC have made this very clear. However, that is not the case when it comes to utility tokens. If you decide to invest in utility tokens, you have better protection. This is because utility tokens generally come under stringent oversight if they share resemblance with investment contracts.

-

Level of Risk

While discussing Utility Tokens vs Meme Coins, one cannot ignore the difference relating to the risk level. The level of risk associated with meme coins is extremely high. These digital assets are highly volatile in nature. Moreover, they are also prone to scams, which can give a nightmare to investors.

However, that is not the case when it comes to utility tokens. The risk relating to utility tokens is certainly lower if it is tied to real utility. Moreover, the fact that they are closely scrutinized to determine if they resemble investment contracts minimizes the chances of scams.

-

Purpose

The purpose of designing a utility token and a meme coin is very different. Utility tokens have been built so that users can access a service or a dApp. Their purpose lies within the blockchain ecosystem. That is not the case when it comes to meme coins.

Meme coins have been created as internet jokes. They have been developed as digital assets for fun. Investors must remember that the purpose of meme coins is speculative in nature. They have no functional role to play within the blockchain ecosystem.

-

Lifecycle

Another major distinction between Meme coins and Utility tokens is related to their respective lifecycles. In the case of meme coins, the lifecycle may typically be short. The lifecycle of these digital assets is influenced by short-term hype trends. As a result, the relevance of these specific types of digital assets may rapidly decrease.

The lifecycle of utility tokens is longer than that of meme coins. Their lifecycle is typically linked with the growth of their blockchain ecosystem. Therefore, utility tokens are much more sustainable in nature in comparison to meme coins.

The table presented below gives an overview of the main differences between meme coins and Utility Tokens. Individuals who wish to invest in crypto need to understand the distinction so that they can make well-informed investment decisions.

Before you invest in crypto, learn the language. Knowing key terms isn’t optional—it’s your first step to making smart, confident decisions in a rapidly evolving market.

Practical Investment Decision for Investors – Meme Coins vs. Utility Tokens

After knowing the difference between Meme Coins and Utility Tokens, investors must carefully make their investment decision. In order to look at the ideal digital asset, you need to take into consideration certain factors such as investment goals, risk level, regulatory aspects, and portfolio strategy.

-

Investment goals

Meme Coins are ideal for traders and investors who are capable of tolerating high volatility. It is also an ideal choice if you are seeking short-term gains from hype cycles. On the other hand, Utility Tokens are better aligned with long-term investors who wish to get exposure to blockchain projects with real-world applications. So if you are interested in decentralized finance or gaming, you must opt for these digital assets.

-

Accepted risk and regulatory aspects

According to the SEC’s 2025 statement on meme coins, these digital assets should not be considered to be securities. Thus, investors do not have any federal protection. As a result, they are exposed to a high level of risk. In the case of Utility tokens, there may be SEC or CFTC oversight in case they function like investment contracts. While such regulation may add compliance costs, it also improves the overall legitimacy.

-

Portfolio allocation strategy

According to experts, keeping meme coins as a tiny percentage of a diversified portfolio can be treated as a lottery ticket. This is because it has the potential to generate short-term wins. However, you must remember that there is no certainty. Utility tokens must make up a larger share of your investment portfolio. The condition is that these virtual assets must have a link with projects with proven adoption and transparent governance.

Entering the crypto world? Start smart—learn how to buy, store, and trade safely to protect your assets and seize every opportunity in this booming market.

Final Words

The final choice between meme coins and utility tokens today depends on how much risk investors want to take. You must bear in mind that meme coins remain highly speculative in nature. Variables such as community sentiment and hype are responsible for fueling these assets in the market. Moreover, they offer limited protection under U.S. securities laws.

When it comes to utility tokens, they are gradually gaining legitimacy. This is because regulators in the U.S. are pushing for definitive regulations now. As an investor, you must be smart to adopt a balanced approach while selecting between these digital assets. To select between these assets, you must consider your investment goals along with accepted risk and portfolio allocation strategy.

Disclaimer

The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Crypto shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!