The growing popularity of cryptocurrencies has created concerns regarding the utility of traditional money in the long run. Will fiat currencies stay relevant in the face of the crypto revolution? People have been enamored by the fact that cryptocurrencies can offer an alternative to traditional money. Cryptocurrencies are not controlled by any government or central bank and no policymaker decides their value.

The Bitcoin vs. traditional money debate denotes a transition in our understanding of money, which has been revolving primarily around physical cash or digital entries in bank accounts. Bitcoin showed that you can be in complete control of your money and financial transactions without intermediaries. Let us learn more about the differences between Bitcoin and physical cash or other forms of traditional money.

Enroll now in the Bitcoin Fundamentals Free Course to gain deep insights on how the Bitcoin blockchain works.

What is Traditional Money?

One of the first things that you must know to uncover the differences between traditional money and Bitcoin is the definition of traditional money. The term ‘traditional money’ may mean different things, including gold coins, copper coins or fiat currency. Gold coins and copper coins were considered as traditional money during the reign of kings and monarchs in the past. In the present times, fiat currency is the most accurate representation of traditional money as people have been trying new forms of money such as digital currencies.

You can understand the cryptocurrency vs. traditional currency debate more easily by learning the traits of fiat currency. Fiat currency refers to the currency issued by the government, which is not pegged against a physical commodity, such as silver or gold. The value of fiat currency depends on the orders of the government and the trust of the public in the issuing authority. You can identify fiat currency with the help of the following traits.

Centralized control is one of the foremost traits of fiat currency or traditional money. Governments and central banks are the common authorities over fiat currency, such as the US Federal Reserve. The centralized authorities are responsible for determining its supply, establishing interest rates and implementing monetary policies.

Central banks also have the power to print more money, which can lead to inflation without proper management. Fiat currency also dictates the direction of monetary policies that aim to achieve economic stability.

The traditional money vs. Bitcoin comparison must also focus on the existence of traditional money in physical and digital forms. You can avail traditional money in physical form as cash and coins, while the digital forms are available in credit cards, online transfers and debit cards.

Another distinctive highlight of traditional money is that fiat currency is always considered as legal tender. It means that the law of the country considers fiat currency as a legitimate method of payment for financial transactions in the issuing country.

What is Bitcoin?

The second player in the comparison, Bitcoin, has emerged as an alternative to traditional money. It was created as a decentralized electronic cash system which operates on blockchain technology. You can find answers to “Is Bitcoin better than real money?” by learning about the following traits of Bitcoin.

Decentralization is one of the foremost traits of Bitcoin as it enables peer-to-peer transactions without any intermediaries. The Bitcoin network operates with the contributions of a global network of nodes and Bitcoin miners.

Bitcoin also stands out with the benefit of cryptographic security, which makes it extremely resistant to counterfeiting and fraud. Bitcoin transactions are completely immutable, thereby suggesting that you cannot modify transactions once you record them on the blockchain.

Another crucial trait that makes Bitcoin a unique alternative to traditional currency is the element of fixed supply. The design of Bitcoin implies that the world will only witness 21 million Bitcoin ever. The inherent scarcity in its design is significantly different from the large, unrestricted supply of fiat currency.

The value of Bitcoin depends significantly on supply and demand, thereby making it one of the most volatile assets. Even after more than a decade, Bitcoin is younger than traditional money. On top of it, the speculative nature of Bitcoin also contributes to its price volatility.

Exploring the Differences between Bitcoin and Traditional Money

The distinctive traits of Bitcoin and fiat currency provide a glimpse of how Bitcoin is different from traditional money. While Bitcoin aims to address the shortcomings of fiat currencies, it also has some limitations of its own. The difference between Bitcoin and traditional money showcases a clear impression of the implications of their role and utility in the global financial system. You can find notable differences between Bitcoin and traditional money in the following areas.

-

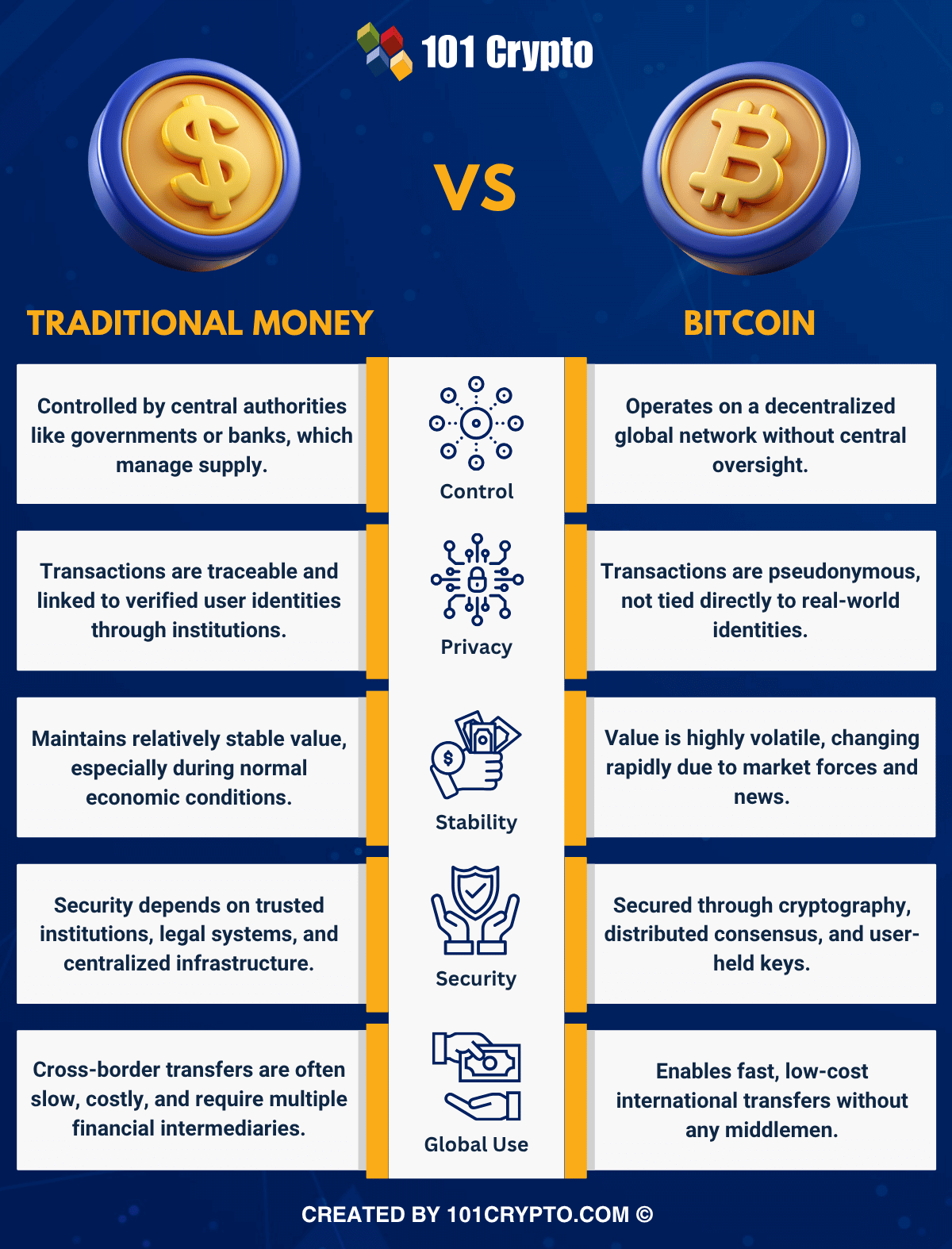

Centralization or Decentralization

The first point of difference between traditional money and Bitcoin or other cryptocurrencies is the element of decentralization. Most of the traditional money or fiat currencies are inherently under the control of centralized authorities. The central authority is solely responsible for issuing and controlling fiat currencies. The centralization in fiat currencies ensures stability while providing a clear framework for monetary policy. You should know that centralized control can allow governments to freeze accounts, censor certain transactions and devalue currency at their will.

On the contrary, Bitcoin follows the principle of decentralization, which implies that there is no central authority. Without the involvement of an intermediary, Bitcoin is completely free from concerns of being controlled by a single entity. Bitcoin users don’t have to trust intermediaries for conducting transactions, thereby allowing unparalleled freedom. However, the lack of a central authority means that users have no one to appeal to when something goes wrong.

-

Pseudonymous or Anonymous

Another crucial pointer for the Bitcoin vs. traditional money comparison is the element of anonymity. Traditional money or fiat currency works through traditional financial systems that require compliance with KYC and AML regulations. As a result, anyone can link the fiat currency transactions to verified identities of users. KYC and AML compliance helps in preventing illegal activities albeit implying a lack of user privacy.

Bitcoin might seem like the sole solution to achieve completely anonymous financial transactions. As a matter of fact, Bitcoin cannot ensure complete anonymity as all the Bitcoin blockchain maintains a public ledger of all transactions. However, the Bitcoin address may not have a direct link to the user’s real identity, thereby making them pseudonymous.

-

Volatility

The most prominent differentiator between fiat currency and Bitcoin is volatility. Traditional money or fiat currencies might be subject to change in value during periods of inflation or economic recession. At the same time, fiat currency showcase relatively better stability in purchasing power over short to medium terms.

Bitcoin, like other cryptocurrencies, has earned infamous reputation for their volatility. The extreme price volatility of Bitcoin has grabbed the headlines now and then for the significant price swings. The value of Bitcoin can fluctuate by unimaginable margins within days or even hours. Some of the notable factors responsible for volatility of Bitcoin include adoption trends, regulatory news and market sentiment.

-

Trust and Security

While working with two different forms of money, you cannot ignore the elements of security and trust. The discussions about the cryptocurrency vs. traditional currency debate draw the limelight towards the role of regulatory bodies, legal frameworks and financial institutions in security of traditional money. The security of traditional money is always at risk due to the threats of financial crisis or centralized data breaches.

Bitcoin stays one step ahead in terms of security with the help of cryptography. The blockchain technology behind Bitcoin ensures that its security depends on distributed nature of the ledger and cryptographic proof of transactions. On top of it, the immense computational power required to validate Bitcoin transactions ensures that it is impossible to make fraudulent transactions pass through. The advantages of immutability and censorship resistance ensure that Bitcoin is more secure than traditional money. At the same time, users should take the responsibility of protecting their private keys.

-

Borderless Transactions

You can also try to find answers to “Is Bitcoin better than real money?” in the ability of both types of money to facilitate borderless transactions. Sadly, traditional money has always been limited by international borders. Cross-border transactions with fiat currency require conversion of currency for international transactions, thereby enhancing complexity and adding more costs.

Bitcoin is an ideal choice for borderless transactions as you can send and receive Bitcoin anywhere in the world. It helps in conducting cross-border transactions instantly without the complexity of traditional financial infrastructure and its intermediaries.

Here is an overview of the differences between traditional money and Bitcoin in a table.

Final Thoughts

The differences between Bitcoin and traditional money reveal that Bitcoin might be one of the strongest alternatives to traditional money in future. For example, Bitcoin and other cryptocurrencies can replace fiat currency in cross-border transactions. Furthermore, Bitcoin is decentralized and does not depend on centralized intermediaries, thereby making them a more democratic form of money. Learn more about cryptocurrencies and discover new insights about their utility now.

Disclaimer

The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Crypto shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!